SAFE is a non-partisan, action-oriented organization committed to combating the economic and national security threats posed by America’s dependence on oil.

The United States’ near-total dependence on oil to power our mobility destabilizes our economy and weakens our national security. Fortunately, America is on the cusp of an innovation revolution, one in which we can improve our energy security by powering our transportation system with a diverse set of fuels while offering greater safety and mobility for millions.

On May 19, SAFE and the members of its Energy Security Leadership Council, co-Chaired by Frederick W. Smith and General James T. Conway, released the 2016 National Strategy for Energy Security: The Innovation Revolution

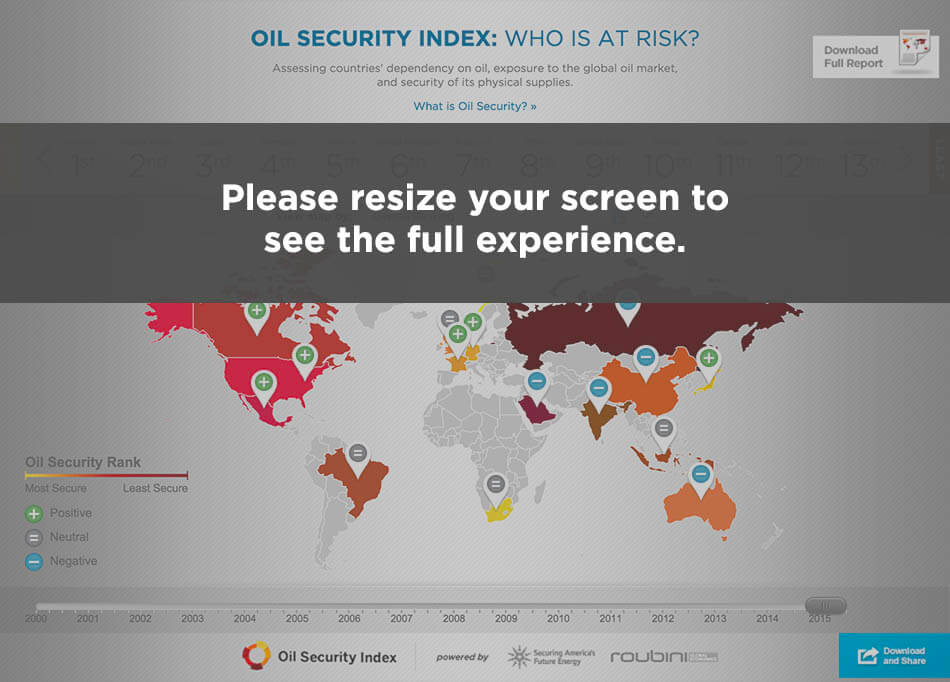

Oil supply and demand in different countries around the world affects their energy security and their vulnerability to the volatile global oil market. The Index combines seven metrics to measure and rank the oil security of sixteen countries. The Index is updated on a quarterly basis.

Assessing countries' dependency on oil, exposure to the global oil market, and security of its physical supplies.

The term oil security can mean different things to different countries. For some—particularly those almost exclusively reliant on imports—physical supply security takes precedence over nearly any other measure. For others, physical supplies may be more dependable, but overall dependence on oil and inefficient use of oil leave their economies exposed to high and volatile oil prices. For each country, it is ultimately a combination of factors: their economy’s structural dependency on oil; their exposure to the price of oil and changes in this price; and the physical security of their oil supplies.

The term oil security can mean different things to different countries. For some—particularly those almost exclusively reliant on imports—physical supply security takes precedence over nearly any other measure. For others, physical supplies may be more dependable, but overall dependence on oil and inefficient use of oil leave their economies exposed to high and volatile oil prices. For each country, it is ultimately a combination of factors: their economy’s structural dependency on oil; their exposure to the price of oil and changes in this price; and the physical security of their oil supplies.

| Overall Ranking | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Oil Intensity | Fuel Consumption per Capita | Spending on Oil | Spending on Net Oil Imports Percent of GDP | Oil Exports Percent of Total Exports | Oil Supply Security | Oil Stockholdings Percent of Consumption | |||

Oil Intensity

|

Fuel Consumption per Capita

|

Spending on Oil

|

Spending on Net Oil Imports Percent of GDP

|

Oil Exports Percent of Total Exports

|

Oil Supply Security

|

Oil Stockholdings Percent of Consumption

|

|||

| Norway | 1st |

Norway has made progress in greater transportation efficiency that looks set to continue, but its export income remains highly dependent on oil, and thus vulnerable to low oil prices.

|

1st 0 | 12th 1 | 4th 2% | 3rd -8% | 14th 33% | 1st 9 | 6th 61% |

| South Africa | 2nd |

Although South Africa’s economy is not particularly reliant on oil, oil makes up a large share of its import bill (it ranks 12th in Total Spending on Net Oil Imports). Consumption-led growth is also increasing the country’s demand for petroleum products, with Fuel Consumption per Capita near tripling since 2000.

|

11th 1 | 4th 0 | 13th 6% | 16th 4% | 1st 0% | 7th 6 | 1st 207% |

| Japan | 3rd |

Japan’s highly-efficient vehicle fleet helps cap oil demand, rendering Fuel Consumption per Capita the lowest among developed countries. Sizeable oil stockpiles also provide some cushion against the possibility of supply shocks.

|

6th 1 | 8th 1 | 6th 3% | 14th 2% | 4th 2% | 14th 5 | 3rd 90% |

| Germany | 4th |

Despite being a sizeable net importer of oil, high levels of efficiency (it currently ranks 3rd in Oil Intensity) and a well-developed pipeline infrastructure mitigate Germany’s oil security risk. Germany also has sizeable oil stockpiles (higher than the United States, relative to consumption) to guard against supply shocks.

|

4th 1 | 11th 1 | 3rd 2% | 10th 2% | 2nd 1% | 12th 5 | 4th 80% |

| France | 5th |

An already well-developed economy, France has continued to improve its efficiency, decreasing its consumption consistently; lower oil prices look set to only add to the benefits of its decreasing need for imports.

|

3rd 1 | 10th 1 | 2nd 2% | 11th 2% | 5th 2% | 13th 5 | 5th 69% |

| United Kingdom | 6th |

The United Kingdom has suffered declining domestic oil production, which has been only partly offset by easing demand. This has resulted in a substantial weakening of its Oil Supply Security (from 8.2 in 2009 to 7.0 since Q2 2013).

|

2nd 0 | 9th 1 | 1st 2% | 7th 1% | 9th 7% | 10th 6 | 10th 29% |

| Australia | 7th |

In recent years, improvement in Australia’s oil intensity has stagnated due to the increase in energy-intensive mining driven in large part by China’s booming demand for commodities. Australia’s Fuel Consumption per Capita is also among the highest in the Index (11th).

|

5th 1 | 13th 1 | 5th 3% | 9th 1% | 6th 3% | 4th 7 | 11th 23% |

| China | 8th |

Despite improvements in vehicle efficiency, China remains heavily reliant on oil and, increasingly, oil imports (the country ranks 11th in Total Spending on Net Oil Imports as a Percentage of GDP). The country also relies heavily on relatively unstable and unpredictable regimes in the Middle East and West Africa, as well as Russia.

|

7th 1 | 3rd 0 | 7th 3% | 12th 2% | 3rd 1% | 11th 5 | 16th 10% |

| United States | 9th |

Most measures of U.S. oil security and reliance have improved over the past decade despite the sharp increase in oil prices. For example, U.S. oil intensity has fallen by one third, and the quantity of oil imports has also declined as consumption has eased and production has risen.

|

8th 1 | 15th 2 | 8th 4% | 8th 1% | 8th 6% | 3rd 7 | 7th 55% |

| Mexico | 10th |

Mexico’s relatively high level of oil production and oil exports, combined with its improving demand-side efficiency, have helped improve its oil security outlook in recent years, though fiscal reliance on oil remains a vulnerability. The country’s Total Spending on Oil as a Percentage of GDP is also among the highest in the Index.

|

12th 1 | 7th 0 | 10th 5% | 5th -2% | 11th 11% | 5th 6 | 12th 21% |

| Canada | 11th |

High and rising domestic oil production more than meets Canada’s domestic demands and attracts sizeable direct foreign investment. As a major oil exporter, particularly to the United States, Negative Total Spending on Net Oil Imports as a Percentage of GDP is also a boon.

|

10th 1 | 14th 2 | 9th 4% | 4th -3% | 13th 18% | 2nd 8 | 9th 38% |

| Brazil | 12th |

Despite (and occasionally because of) the sizeable use of ethanol as an alternative to oil in the transportation sector, Brazilian consumers pay a relatively high price for retail fuel, but consume among the lowest on a per capita basis (it currently ranks 4th in Fuel Consumption per Capita).

|

9th 1 | 5th 0 | 12th 6% | 6th 0% | 10th 9% | 8th 6 | 14th 14% |

| Indonesia | 13th |

Indonesia has adapted to being a net oil importer, and while it has made consistent improvements in oil intensity, consumption per capita has been on an upward trend that could pose problems if oil prices spike.

|

13th 1 | 2nd 0 | 11th 5% | 13th 2% | 7th 4% | 9th 6 | 13th 20% |

| India | 14th |

Although the oil intensity of India’s economy has decreased by 30 percent since 2000, the volumes of oil being imported and consumed have risen sharply, undermining its fiscal and external balances (it currently ranks 13th in Total Spending on Net Oil Imports as a Percentage of GDP).

|

14th 2 | 1st 0 | 14th 8% | 15th 4% | 12th 13% | 15th 5 | 15th 12% |

| Saudi Arabia | 15th |

Saudi Arabia’s high oil intensity, rising domestic energy use, and fiscal reliance on oil make it extremely vulnerable to changing oil prices. The oil intensity of the economy and the average oil use per capita is high and rising, about 10 times and 3 times greater respectively than the most efficient countries.

|

16th 4 | 16th 2 | 16th 13% | 1st -30% | 16th 76% | 6th 6 | 2nd 112% |

| Russia | 16th |

Russia’s high oil intensity, limited oil stockpiles, and heavy dependence of its fiscal account on oil export revenues contribute to a low ranking. As a result of its poor business environment and policy uncertainty, Russia’s Oil Supply Security is also the lowest despite being a major oil producer.

|

15th 2 | 6th 0 | 15th 13% | 2nd -13% | 15th 47% | 16th 3 | 8th 38% |

| U.S. Overall Index Score | ||||||||

|---|---|---|---|---|---|---|---|---|

| Oil Intensity | Fuel Consumption per Capita | Spending on Oil | Spending on Net Oil Imports Percent of GDP | Oil Exports Percent of Total Exports | Oil Supply Security | Oil Stockholdings Percent of Consumption | ||

| U.S. Spotlight » |

U.S. Overall Index Score

|

Oil Intensity

|

Fuel Consumption per Capita

|

Spending on Oil

|

Spending on Net Oil Imports Percent of GDP

|

Oil Exports Percent of Total Exports

|

Oil Supply Security

|

Oil Stockholdings Percent of Consumption

|

| 2015 - Q3 | 101 | 103 1 | 101 2 | 100 4% | 100 1% | 98 6% | 104 7 | 101 55% |

| 2015 - Q2 | 101 | 103 1 | 101 2 | 99 4% | 100 1% | 98 6% | 103 7 | 101 55% |

| 2015 - Q1 | 101 | 103 1 | 101 2 | 100 4% | 100 1% | 98 6% | 103 7 | 101 55% |

| 2014 Average | 100 | 103 1 | 101 2 | 98 7% | 99 1% | 97 7% | 102 7 | 101 54% |

| 2014 - Q4 | 101 | 103 1 | 101 2 | 99 5% | 100 1% | 97 7% | 103 7 | 101 54% |

| 2014 - Q3 | 100 | 103 1 | 101 2 | 98 7% | 99 1% | 97 7% | 102 6 | 101 54% |

| 2014 - Q2 | 100 | 103 1 | 101 2 | 98 7% | 99 1% | 97 7% | 102 6 | 101 54% |

| 2014 - Q1 | 100 | 103 1 | 101 2 | 98 7% | 99 1% | 97 7% | 102 6 | 101 55% |

| 2013 Average | 100 | 103 1 | 102 2 | 98 7% | 99 2% | 98 7% | 102 6 | 102 56% |

| 2013 - Q4 | 100 | 103 1 | 101 2 | 98 7% | 99 1% | 97 7% | 102 6 | 101 55% |

| 2013 - Q3 | 100 | 103 1 | 102 2 | 98 8% | 99 1% | 97 7% | 102 6 | 102 56% |

| 2013 - Q2 | 100 | 103 1 | 102 2 | 98 7% | 99 2% | 98 6% | 102 6 | 102 56% |

| 2013 - Q1 | 100 | 103 1 | 102 2 | 98 7% | 99 2% | 98 6% | 102 6 | 102 56% |

| 2012 Average | 100 | 103 1 | 101 2 | 98 8% | 98 2% | 98 6% | 101 6 | 102 56% |

| 2012 - Q4 | 100 | 103 1 | 102 2 | 98 7% | 98 2% | 98 7% | 101 6 | 102 56% |

| 2012 - Q3 | 100 | 103 1 | 102 2 | 98 8% | 98 2% | 98 6% | 101 6 | 102 56% |

| 2012 - Q2 | 100 | 103 1 | 101 2 | 98 8% | 98 2% | 98 6% | 101 6 | 102 55% |

| 2012 - Q1 | 100 | 103 1 | 101 2 | 97 8% | 98 2% | 98 6% | 101 6 | 102 56% |

| 2011 Average | 100 | 102 1 | 101 2 | 98 8% | 98 2% | 98 5% | 101 6 | 102 57% |

| 2011 - Q4 | 100 | 103 1 | 101 2 | 98 8% | 98 2% | 98 6% | 101 6 | 102 56% |

| 2011 - Q3 | 100 | 102 1 | 101 2 | 97 8% | 98 2% | 98 6% | 101 6 | 102 57% |

| 2011 - Q2 | 100 | 102 1 | 101 2 | 97 8% | 98 2% | 98 5% | 100 6 | 102 57% |

| 2011 - Q1 | 100 | 102 1 | 101 2 | 98 7% | 98 2% | 98 5% | 100 6 | 102 57% |

| 2010 Average | 100 | 102 1 | 101 2 | 98 6% | 99 2% | 99 4% | 101 6 | 102 58% |

| 2010 - Q4 | 100 | 102 1 | 101 2 | 98 7% | 98 2% | 99 4% | 100 6 | 102 58% |

| 2010 - Q3 | 100 | 102 1 | 101 2 | 99 6% | 98 2% | 99 4% | 100 6 | 102 58% |

| 2010 - Q2 | 100 | 102 1 | 101 2 | 98 6% | 99 2% | 99 4% | 101 6 | 102 58% |

| 2010 - Q1 | 100 | 102 1 | 101 2 | 99 6% | 99 2% | 99 4% | 101 6 | 102 58% |

| 2009 Average | 100 | 102 1 | 101 2 | 99 5% | 99 2% | 99 3% | 101 6 | 102 56% |

| 2009 - Q4 | 100 | 102 1 | 101 2 | 99 6% | 99 1% | 99 3% | 100 6 | 102 58% |

| 2009 - Q3 | 100 | 102 1 | 101 2 | 99 5% | 99 1% | 99 3% | 100 6 | 102 57% |

| 2009 - Q2 | 100 | 102 1 | 101 2 | 99 5% | 98 2% | 99 3% | 101 6 | 102 56% |

| 2009 - Q1 | 100 | 102 1 | 100 2 | 100 4% | 98 2% | 99 3% | 101 6 | 101 54% |

| 2008 Average | 99 | 102 1 | 100 2 | 98 8% | 97 3% | 99 3% | 99 6 | 100 51% |

| 2008 - Q4 | 100 | 102 1 | 100 2 | 99 5% | 97 3% | 99 4% | 99 6 | 101 53% |

| 2008 - Q3 | 99 | 102 1 | 100 2 | 97 9% | 96 3% | 99 4% | 99 6 | 100 51% |

| 2008 - Q2 | 99 | 102 1 | 99 2 | 97 10% | 97 3% | 99 3% | 99 6 | 100 51% |

| 2008 - Q1 | 99 | 102 1 | 99 2 | 98 8% | 97 2% | 99 2% | 99 6 | 100 51% |

| 2007 Average | 99 | 102 1 | 99 2 | 98 6% | 98 2% | 99 2% | 99 6 | 100 51% |

| 2007 - Q4 | 99 | 102 1 | 99 2 | 98 7% | 98 2% | 99 2% | 99 6 | 100 51% |

| 2007 - Q3 | 99 | 102 1 | 99 2 | 98 6% | 98 2% | 99 2% | 99 6 | 100 51% |

| 2007 - Q2 | 99 | 102 1 | 99 2 | 98 6% | 98 2% | 99 2% | 99 6 | 100 51% |

| 2007 - Q1 | 100 | 102 1 | 99 2 | 99 5% | 98 2% | 99 2% | 99 6 | 100 51% |

| 2006 Average | 100 | 101 1 | 99 2 | 99 6% | 98 2% | 100 2% | 101 6 | 100 51% |

| 2006 - Q4 | 100 | 102 1 | 99 2 | 99 5% | 98 2% | 99 2% | 101 6 | 100 51% |

| 2006 - Q3 | 100 | 101 1 | 99 2 | 98 6% | 98 2% | 100 2% | 100 6 | 100 51% |

| 2006 - Q2 | 100 | 101 1 | 99 2 | 98 6% | 98 2% | 100 2% | 101 6 | 100 51% |

| 2006 - Q1 | 100 | 101 1 | 99 2 | 99 5% | 98 2% | 100 2% | 101 6 | 100 51% |

| 2005 Average | 100 | 101 2 | 99 2 | 99 5% | 99 2% | 100 2% | 100 6 | 100 49% |

| 2005 - Q4 | 100 | 101 1 | 99 2 | 99 5% | 98 2% | 100 2% | 100 6 | 100 50% |

| 2005 - Q3 | 100 | 101 2 | 99 2 | 98 6% | 99 2% | 100 2% | 101 6 | 100 49% |

| 2005 - Q2 | 100 | 101 2 | 99 2 | 99 5% | 99 2% | 100 2% | 100 6 | 100 49% |

| 2005 - Q1 | 100 | 101 2 | 99 2 | 99 5% | 99 1% | 100 1% | 100 6 | 100 48% |

| 2004 Average | 100 | 101 2 | 99 2 | 100 4% | 100 1% | 100 1% | 100 6 | 99 47% |

| 2004 - Q4 | 100 | 101 2 | 99 2 | 99 4% | 99 1% | 100 1% | 100 6 | 99 48% |

| 2004 - Q3 | 100 | 101 2 | 99 2 | 99 4% | 100 1% | 100 1% | 100 6 | 99 47% |

| 2004 - Q2 | 100 | 101 2 | 99 2 | 100 4% | 100 1% | 100 1% | 100 6 | 99 47% |

| 2004 - Q1 | 100 | 101 2 | 99 2 | 100 3% | 100 1% | 100 1% | 100 6 | 99 47% |

| 2003 Average | 100 | 101 2 | 99 2 | 100 3% | 100 1% | 100 1% | 100 6 | 99 47% |

| 2003 - Q4 | 100 | 101 2 | 99 2 | 100 3% | 100 1% | 100 1% | 100 6 | 99 47% |

| 2003 - Q3 | 100 | 101 2 | 99 2 | 100 3% | 100 1% | 100 1% | 100 6 | 99 47% |

| 2003 - Q2 | 100 | 101 2 | 99 2 | 100 3% | 100 1% | 100 1% | 100 6 | 99 46% |

| 2003 - Q1 | 100 | 101 2 | 99 2 | 100 3% | 100 1% | 100 1% | 100 6 | 99 47% |

| 2002 Average | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 49% |

| 2002 - Q4 | 100 | 101 2 | 99 2 | 100 3% | 100 1% | 100 1% | 100 6 | 99 48% |

| 2002 - Q3 | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 48% |

| 2002 - Q2 | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 49% |

| 2002 - Q1 | 100 | 100 2 | 100 2 | 100 2% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2001 Average | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2001 - Q4 | 100 | 100 2 | 100 2 | 101 2% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2001 - Q3 | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2001 - Q2 | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2001 - Q1 | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2000 Average | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2000 - Q4 | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2000 - Q3 | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2000 - Q2 | 100 | 100 2 | 100 2 | 100 3% | 100 1% | 100 1% | 100 6 | 100 50% |

| 2000 - Q1 | 100 | 100 2 | 100 2 | 100 0% | 100 0% | 100 0% | 100 6 | 100 0% |

This score shows changes in U.S. oil security over time. It is calculated by combining results for each metric that are normalized over the entire time series. The score is indexed at 100 in Q1 2000, the first time period.

| Proved Reserves | Production | Consumption | Economic Indicators | ||||

|---|---|---|---|---|---|---|---|

| Billion Barrels (2013) | 2013 (Million Barrels per day) | Change 2009-2013 (Million Barrels per Day) | 2013 (Million Barrels per Day) | Change 2009-2013 (Million Barrels per Day) | GDP Forecast 2014 (%) | Annual Average GDP Growth 2009-2013 (%) | |

| Australia | 4 | 0 | 0 | 1% | 0 | 3% | 2% |

| Brazil | 16 | 2 | 0 | 3% | 1 | 0% | 3% |

| Canada | 174 | 4 | 1 | 2% | 0 | 2% | 1% |

| China | 18 | 4 | 0 | 11% | 3 | 7% | 9% |

| Germany | 0 | 0 | 0 | 2% | 0 | 1% | 1% |

| India | 6 | 1 | 0 | 4% | 1 | 6% | 7% |

| Japan | 0 | 0 | 0 | 5% | 0 | 1% | 0% |

| Mexico | 11 | 3 | 0 | 2% | 0 | 2% | 2% |

| Russia | 93 | 11 | 1 | 3% | 1 | 0% | 1% |

| Saudi Arabia | 266 | 12 | 2 | 3% | 1 | 5% | 6% |

| South Africa | 0 | 0 | 0 | 1% | 0 | 1% | 2% |

| United Kingdom | 3 | 1 | 0 | 15% | 0 | 3% | 0% |

| United States | 44 | 10 | 3 | 19% | 0 | 2% | 1% |

This metric is calculated as the volume of oil consumed in a country divided by constant GDP (2005 U.S. dollars). [Barrels of oil consumed per $1,000 of GDP]

This metric is calculated as the volume of fuel consumed in a country divided by the country’s population. The fuel volume includes gasoline, gas oil and diesel oil. [Gallons per Capita per Day]

This metric is calculated as the volume of oil consumed in a country multiplied by the nominal oil price in U.S. dollars, then divided by the country’s nominal GDP in U.S. dollars. The oil volume includes crude oil, gas oil, diesel oil, gasoline, kerosene and fuel oil. Consumption is calculated from production, import, export and stock data. Oil prices are taken as the average wholesale spot market price across a selection of countries and regions. [Percent]

This metric is calculated as the volume of net oil imports multiplied by the oil price, then divided by nominal GDP. For net oil-exporting countries, this measures the revenue from net oil exports as a percentage of GDP. Again, this volume includes crude oil, gas oil, diesel oil, gasoline, kerosene and fuel oil. The oil price is the average wholesale market price. [Percent]

This metric is calculated as the value of oil exports divided by the value of total exports. The value of oil exports is calculated using the volume of exports multiplied by the oil price. Again, oil volume includes crude oil, gas oil, diesel oil, gasoline, kerosene and fuel oil. The oil price is the average wholesale market price. [Percent]

Using a modified version of RGE’s SIRR indicators focused on political risk, terrorism risk, and political institutions scores, this metric is calculated as a weighted average of the scores for each country an Index country imports oil from (proportional to its share of total imports), and a score for the Index country’s domestic oil production (which can be zero). Combined this provides a composite risk score for a country’s estimated oil consumption (calculated as the total volume of domestic production plus net imports). [Score 0-10]

This metric is calculated as the total volume of stocks divided by the total volume of quarterly oil consumption. Crude oil, gas oil, diesel oil, gasoline, kerosene and fuel oil are included in the volume of stocks. The lack of reliable data for China, Russia and South Africa necessitates the use of estimates. Consumption is implied from production, import, export and stock data. [Percent]

1111 19th Street, NW #406, Washington, DC 20036